AI Demand Drives Record Earnings Forecast for TSMC

Pune, India, October 13, 2025– This impressive growth is largely fueled by skyrocketing AI demand for infrastructure. Analysts forecast a 28% increase in net profit, marking TSMC’s seventh consecutive quarter of growth, a clear sign of the company’s expanding influence in the semiconductor industry.

TSMC is a vital supplier for major technology players such as Nvidia and Apple. The company is expected to earn around T$415.4 billion (approximately $13.55 billion) for the quarter ending September 30, according to data compiled by LSEG SmartEstimate. This figure would surpass TSMC’s previous quarterly high of T$398.3 billion and underscores the company’s dominant position in the AI chip market, propelled by the surging AI demand globally.

The company has already reported a 30% rise in revenue for the quarter, exceeding market expectations. Industry experts are optimistic that this momentum will persist, driven by the increasing need for advanced chips used in AI applications, cloud computing, and data centers, all areas where AI demand continues to grow rapidly.

Mario Morales, a senior executive at research firm IDC, explained why TSMC is so well-positioned in the market. “AI infrastructure is expanding at an unprecedented rate, and companies like Nvidia and AMD rely heavily on TSMC for their chip manufacturing needs,” he said. Morales also pointed out that the sustained AI demand is a key factor driving the company’s revenue growth, which he projects will be between 30% and 35% this year.

Despite ongoing global trade tensions and uncertainties related to tariffs, the demand for AI chips remains robust. Morales described the current AI infrastructure race as a “strategic land grab,” with major cloud providers and tech firms investing heavily to secure their foothold in the future of computing.

However, some challenges remain. Taiwan faces a 20% tariff on exports to the U.S., although semiconductors are not currently subject to these tariffs. Last month, U.S. Commerce Secretary Howard Lutnick suggested that Taiwanese chip manufacturers, including TSMC, split their production evenly between Taiwan and the United States. Currently, most of TSMC’s manufacturing is based in Taiwan, and the suggestion met resistance from Taiwanese officials. Nevertheless, TSMC is already making significant investments in the U.S., with plans to spend $165 billion on new fabrication plants in Arizona.

Investor confidence in TSMC remains high despite these geopolitical uncertainties. The company’s stock has surged 30% this year, buoyed by optimism about AI’s transformative role in technology and the strong demand for AI chips. This growth in TSMC’s shares has contributed to a 16.9% increase in Taiwan’s benchmark stock index over the same period.

TSMC is scheduled to release its official earnings report on Thursday, followed by a conference call at 0600 GMT. During this call, the company is expected to provide updated guidance for the fourth quarter and address questions related to trade policies and future investment plans.

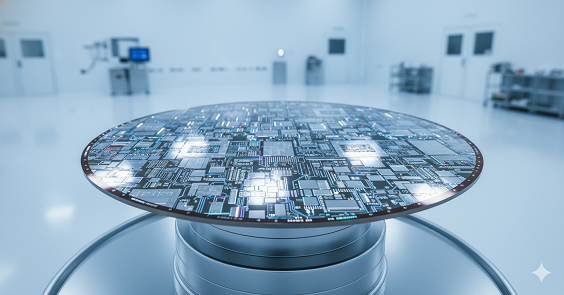

As Asia’s most valuable publicly traded company, TSMC boasts a market capitalization of about $1.22 trillion, nearly three times that of its nearest competitor, Samsung Electronics. The company’s leadership in cutting-edge chip manufacturing has made it a cornerstone of the global tech industry. This leadership position becomes even more critical as AI continues to transform business operations and consumer technologies.

From powering smart devices to supporting complex data processing in cloud environments, TSMC’s chips lie at the heart of the ongoing digital transformation. With AI demand showing no signs of slowing down, the company is expected to maintain its impressive growth trajectory.

TSMC’s strategy of investing heavily in global manufacturing capabilities, forming strong partnerships with leading tech firms, and delivering high-performance chips positions it as a key player in the future of technology. While geopolitical risks and trade policies pose challenges, TSMC’s solid fundamentals and clear strategic vision provide a strong foundation for continued industry leadership.